26+ Compound interest mortgage

Use the Compound Interest Calculator to learn more about or do calculations involving compound interest. How to calculate compound interest.

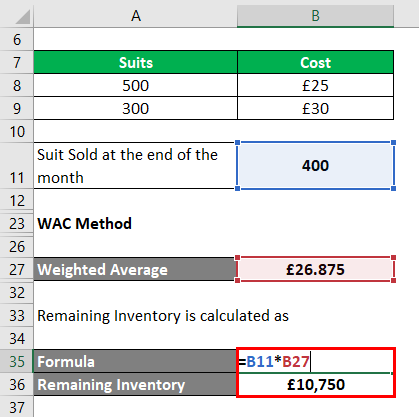

Inventory Valuation Methods Types Advantages And Disadvantages

Finally continuously compounding interest grows at the fastest rate and is the formula that most banks use for mortgage loans.

. For example you might want to calculate mortgage interest for a mortgage of 500000 with monthly payments of 2500 at a 3 mortgage rate. Compound Interest Explanation. The term commercial is used to distinguish it from an investment bank a type of financial services entity which instead of lending money directly to a business helps businesses raise money from other firms in the form of bonds debt or share capital equityThe primary operations of commercial banks include.

Mortgage hypothec life annuity. Find out which are the best compound interest investments for returns that will grow your money generate wealth and get rich. The information you need for any of these calculations is generally the same but the math is a bit different for each.

How Much Interest Does 1 Million Earn Per Year. Note These formulas assume that the deposits payments are made at the end of each compound period. Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase.

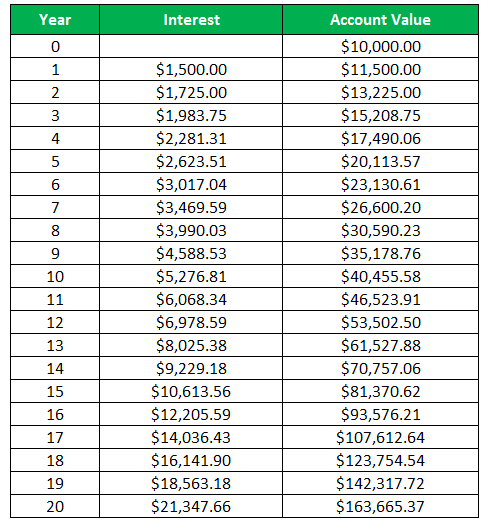

Compound interest on a loan or deposit accrues on both the initial principal and the accumulated. Jefferson earned the annual interest rate of 481 which is not a bad rate of return. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

The Principle of Compound Interest. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Compound interest is calculated using the compound interest formula.

Current Mortgage Interest Rates. By Anna Barker April 20 2020 May 26 2021. Plus you can also program a daily compound interest calculator Excel formula for offline use.

What Is a PLUS Loan. Breaking Bad is an American crime drama television series created and produced by Vince GilliganSet and filmed in Albuquerque New Mexico the series follows Walter White Bryan Cranston an underpaid overqualified and dispirited high-school chemistry teacher who is struggling with a recent diagnosis of stage-three lung cancerWhite turns to a life of crime and. To calculate interest paid on a mortgage you will first need to know your mortgage balance the amount of your monthly mortgage payment and your mortgage interest rate.

Financial Modeling in Excel 13 Investment Banking Basics 120 Investment Banking Careers 26 Trading for dummies 67 valuation basics 27 Finance Blog Courses. 10481 1 r. Thats a maximum loan amount of roughly 253379.

Compound interest is a bit more complicated and a bit more valuable. Find out the initial principal amount that is required to be invested. How to Calculate Principal and Interest.

The following lines of credit charge compound interest. To compute compound interest we need to follow the below steps. You can find many of these calculators online.

In the world of personal finance interest is an amount paid over a previously established amount and it is invariably expressed as a percentage that we call interest. However simple interest is very seldom used in the real world. Until the secured loan is fully paid.

This article may contain affiliate links. A commercial bank is what is commonly referred to as simply a bank. Compound interest is the product of the initial principal amount by one plus the annual interest rate raised to the number of compounded periods minus one.

CD Calculator Compound Interest Calculator. Help homebuyers reduce their monthly mortgage payments and interest rates. A loan term is the duration of the loan given that required minimum payments are made each month.

Joes total monthly mortgage payments including principal interest taxes and insurance shouldnt exceed 1400 per month. The 30-year jumbo mortgage rate had a 52-week low of 519 and. Compounding interest requires more than one period so lets go back to the example of Derek borrowing 100 from the bank for two years at a 10 interest rate.

Reunion Island 974. Defaulting on a. Absolute Value Formula.

All banking calculators. Reliable and very secure with a good interest rate. Bangkok September 6 2022 Bitkub Blockchain Technology Bitkub Chain and Bitkub NFT developer invite you to open the new experience of the digital world and participate in the NFT activities at Bitkub NFT Fair event on September 10-11 at Bitkub M Social Helix Building 9th floor The Emquatier.

Compound savings calculator. Subtract the initial balance if you want to know the total interest earned. The current average interest rate on a 30-year fixed-rate jumbo mortgage is 605 010 up from last week.

Especially if you end up owing more money through your. Compare for example a bond paying 6 percent semiannually that is coupons of 3 percent twice a year with a certificate of deposit that pays 6 percent interest once a yearThe total interest payment is 6 per 100 par value in both cases but the holder of the semiannual bond. Jumbo Mortgage Rates.

26 of 45. The 11 Best Compound Interest Investments To Grow Your Wealth. HOUSES AND VILLA IN SPAIN ORIHUELA ALICANTE ALL OF DIFFERENT PRICES AND CHARACTERISTICS TO 20 MINUTES.

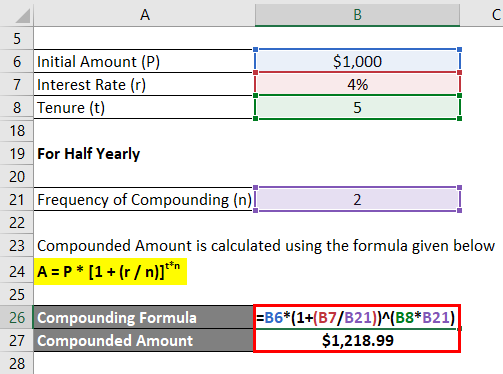

The term of the loan can affect the structure of the loan in many ways. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. According to Figure 1 this means that type0 the default for the FV functionIf I wanted to deposit 1000 at the beginning of each year for 5 years the FV function in Excel allows me to calculate the result as FV45-10001 where type1Just remember.

A personal loan from a bank or credit union. Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods.

The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to. Compound interest includes interest earned on the interest that was previously accumulated. Even when people use the everyday word interest they are usually referring to interest that compounds.

March 26 2021 PAY1069129. Here we discussed how to calculate Daily Compound Interest with examples Calculator and excel template. Your proposed housing payment then could be somewhere between 26 and 35 of your income or 1820 to 2450.

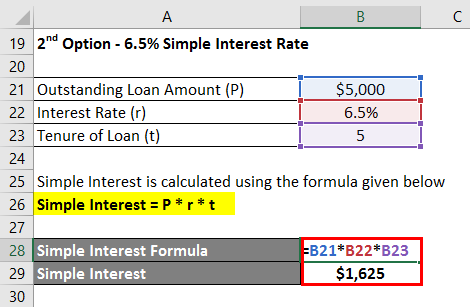

Interest Formula Calculator Examples With Excel Template

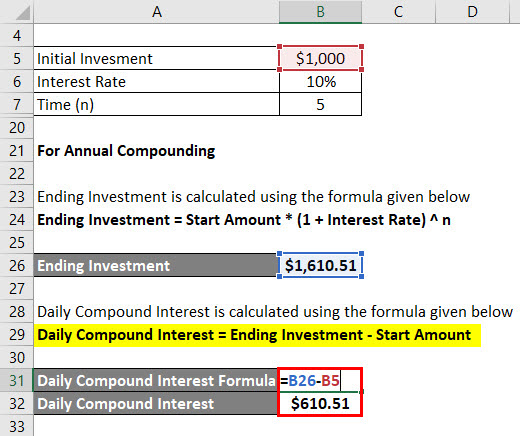

Daily Compound Interest Formula Calculator Excel Template

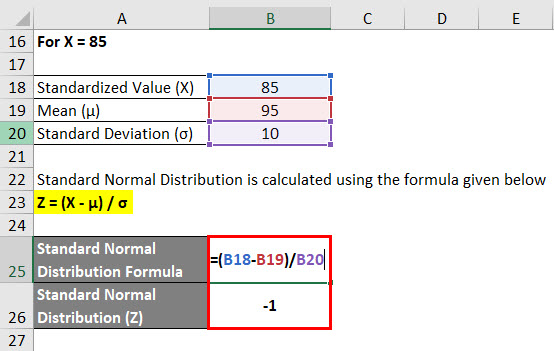

Standard Normal Distribution Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

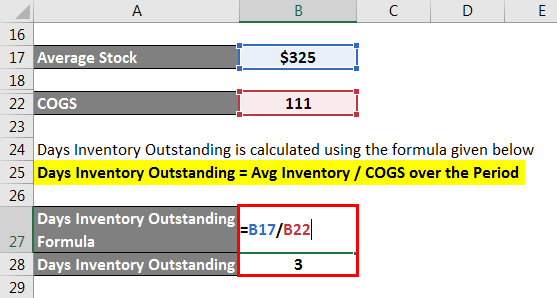

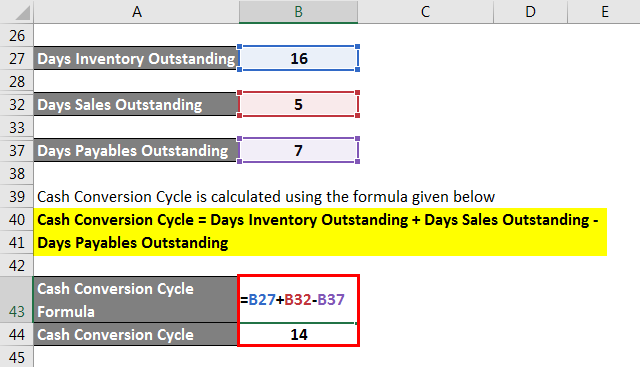

Cash Conversion Cycle Examples Advantages And Disadvantages

Cash Conversion Cycle Examples Advantages And Disadvantages

Daily Compound Interest Formula Calculator Excel Template

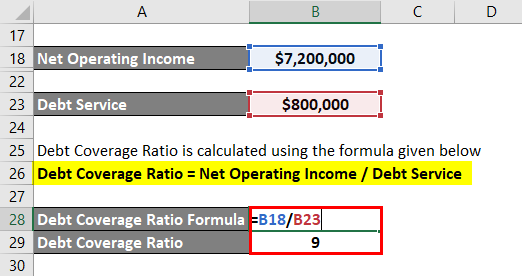

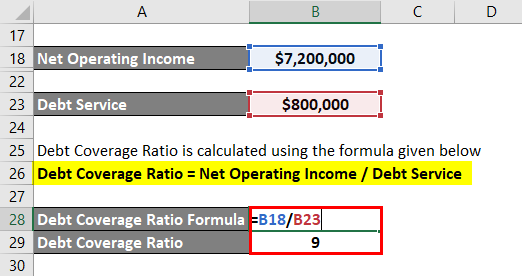

Debt Coverage Ratio Example And Importance Of Debt Coverage Ratio

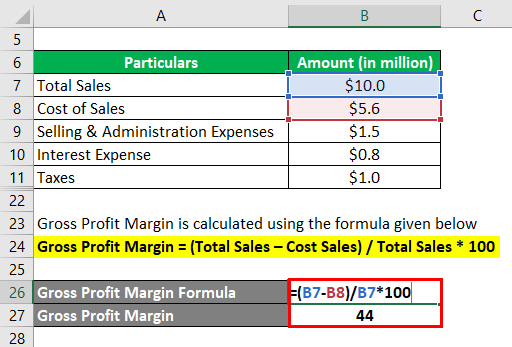

Profit Margin L Most Important Metric For Financial Analysis

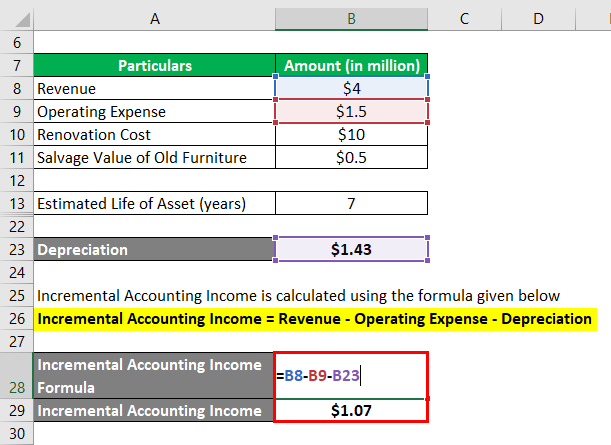

Accounting Rate Of Return Formula Examples With Excel Template

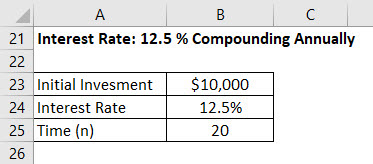

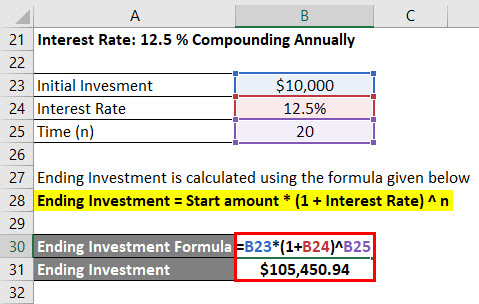

Compound Interest Example Practical Examples With Formula

Maturity Value Formula Calculator Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Free 6 Sample Agreements For Labour Contract Templates In Ms Word Pdf Contract Template Contract Agreement Ms Word

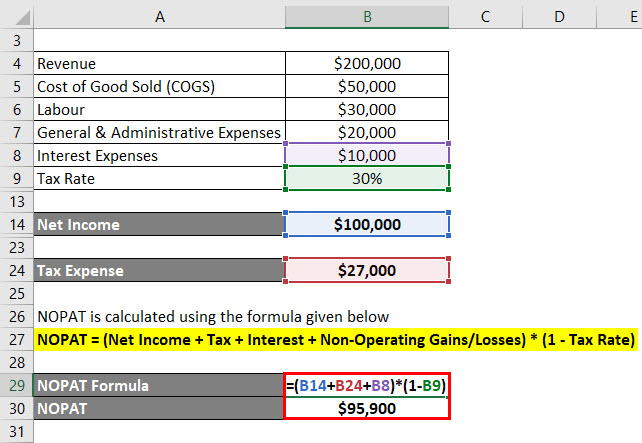

Nopat Formula How To Calculate Nopat Excel Template

Compounding Formula Calculator Examples With Excel Template

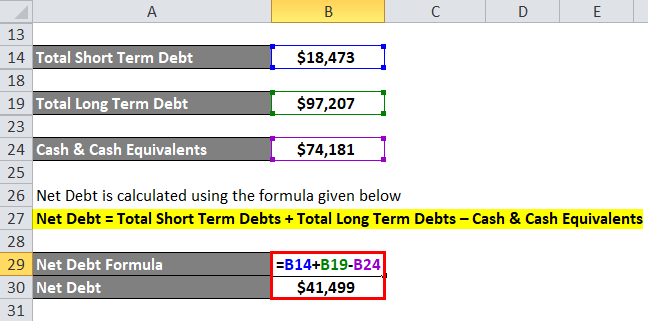

Net Debt Formula Calculator With Excel Template